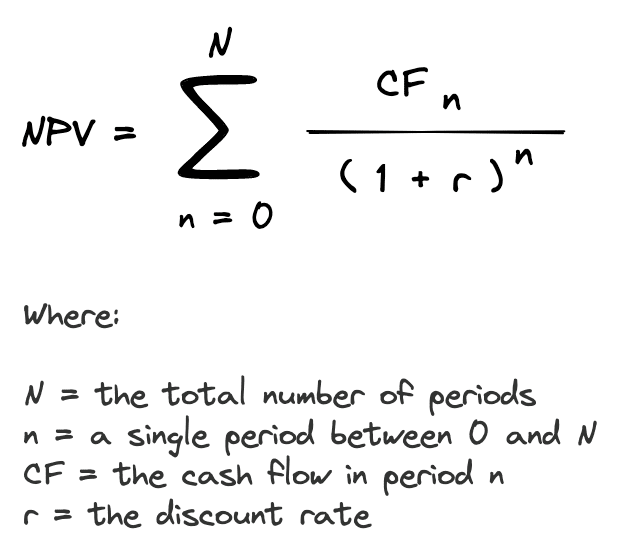

What Is A Discount Rate In Valuation . understand the discount rate used in a business valuation. In other words, it represents. discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf). What comprises the discount rate and what’s a reasonable. the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment.

from propertymetrics.com

discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf). discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). understand the discount rate used in a business valuation. What comprises the discount rate and what’s a reasonable. the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. In other words, it represents.

Understanding Present Value Formulas PropertyMetrics

What Is A Discount Rate In Valuation What comprises the discount rate and what’s a reasonable. the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. understand the discount rate used in a business valuation. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). What comprises the discount rate and what’s a reasonable. discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. In other words, it represents. discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf).

From quantrl.com

How to Calculate a Discount Rate Quant RL What Is A Discount Rate In Valuation discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. the discount rate formula divides the future value (fv) of a cash. What Is A Discount Rate In Valuation.

From propertymetrics.com

Understanding Present Value Formulas PropertyMetrics What Is A Discount Rate In Valuation In other words, it represents. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. understand the discount rate used in a business valuation. What comprises the discount rate and what’s a reasonable. discount rate refers to the rate of interest. What Is A Discount Rate In Valuation.

From propertymetrics.com

What You Should Know About the Discount Rate PropertyMetrics What Is A Discount Rate In Valuation the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf). a discount rate, in the context of investment, is the rate. What Is A Discount Rate In Valuation.

From valutico.com

Discounted Cash Flow Analysis—Your Complete Guide with Examples Valutico What Is A Discount Rate In Valuation In other words, it represents. discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. What comprises the discount rate and what’s. What Is A Discount Rate In Valuation.

From www.slideserve.com

PPT Introduction to Valuation The Time Value of Money PowerPoint What Is A Discount Rate In Valuation discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. In other words, it represents. a discount rate, in the context of investment, is the. What Is A Discount Rate In Valuation.

From www.erp-information.com

What is the Bill Discounting Procedure? (Example and Formula) What Is A Discount Rate In Valuation discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf). discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. understand the discount rate used in a business valuation. What comprises the discount rate and. What Is A Discount Rate In Valuation.

From corporatefinanceinstitute.com

Discount Rate Definition, Types and Examples, Issues What Is A Discount Rate In Valuation a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. discount rates are the percentage rates used in. What Is A Discount Rate In Valuation.

From leaddeveloper.com

How To Use Discounted Cash Flow For Real Estate Valuation? What Is A Discount Rate In Valuation In other words, it represents. discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. What comprises the discount rate and what’s a reasonable. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the. What Is A Discount Rate In Valuation.

From www.clydebankmedia.com

What is a Discounted Cash Flow Analysis? ClydeBank Media What Is A Discount Rate In Valuation In other words, it represents. discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. the discount rate formula divides the. What Is A Discount Rate In Valuation.

From quizgrouchiest.z4.web.core.windows.net

How To Calculate Discount Points What Is A Discount Rate In Valuation discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. the discount rate formula divides the future value (fv) of a. What Is A Discount Rate In Valuation.

From www.slideserve.com

PPT VALUATION Valuation, discount rate, discount rate, growth rate What Is A Discount Rate In Valuation a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. In other words, it represents. discount rate is used to convert future. What Is A Discount Rate In Valuation.

From daystar-properties.com

Unlocking Property Value The Discounted Cash Flow Method Explained What Is A Discount Rate In Valuation discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). understand the discount rate used in a business valuation. discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow. What Is A Discount Rate In Valuation.

From www.genesislawfirm.com

Cash Flow Valuation Part 4 of How to Value a Small Business Genesis What Is A Discount Rate In Valuation discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). understand the discount rate used in a business valuation. In other words, it represents. a discount rate, in the context of investment, is the rate of return used to determine. What Is A Discount Rate In Valuation.

From www.slideserve.com

PPT Valuation capital & discount rate PowerPoint Presentation ID What Is A Discount Rate In Valuation What comprises the discount rate and what’s a reasonable. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. understand the discount. What Is A Discount Rate In Valuation.

From efinancemanagement.com

Discounted Cash Flow Model Formula, Example & Interpretation eFM What Is A Discount Rate In Valuation discount rates are the percentage rates used in evaluating the present value of future cash flows of an investment. discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf). What comprises the discount rate and what’s a reasonable. understand the discount rate used in. What Is A Discount Rate In Valuation.

From 1investing.in

Discount Rate Business Valuation Glossary ValuAdder India Dictionary What Is A Discount Rate In Valuation In other words, it represents. understand the discount rate used in a business valuation. a discount rate, in the context of investment, is the rate of return used to determine the present value of future cash flows from the investment. discount rate is used to convert future anticipated cash flow from the company to present value using. What Is A Discount Rate In Valuation.

From exoavphej.blob.core.windows.net

Calculate Discount Rate For Present Value at Michele Atkinson blog What Is A Discount Rate In Valuation discount rate is used to convert future anticipated cash flow from the company to present value using the discounted cash flow approach (dcf). the discount rate formula divides the future value (fv) of a cash flow by its present value (pv), raises the result to the. understand the discount rate used in a business valuation. discount. What Is A Discount Rate In Valuation.

From mercercapital.com

Understand the Discount Rate Used in a Business Valuation Mercer Capital What Is A Discount Rate In Valuation In other words, it represents. discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its net present value (npv). What comprises the discount rate and what’s a reasonable. the discount rate formula divides the future value (fv) of a cash flow by its present value. What Is A Discount Rate In Valuation.